When someone books your property on Vrbo, it’s like giving them the responsibility to care for your home or apartment while you’re away. Unfortunately, you can’t be sure that all guests will treat your property with the same care they would their own. Consequently, this means you might face unexpected issues that could lead to significant financial losses. To protect yourself, it’s crucial to choose the appropriate Vrbo insurance ahead of time.

In this guide, we’ll explain how Vrbo insurance works. Our goal is to help you safeguard your vacation rental property in the most effective way.

If you list your property on multiple platforms, you might also want to learn more about the Airbnb damage policy.

What is Vrbo Insurance for Host?

When vacation rental guests stay at your property, you immediately take responsibility for their safety.

The Rental Property Liability Insurance Program offered by Vrbo provides essential protection for homeowners and property managers.

- All accommodations booked through Vrbo include this insurance at no extra cost.

- For Vrbo hosts without liability insurance, this program will be the first line of defense if someone files a claim against you.

- If you already have other liability insurance, you can view this as an additional layer of coverage. In other words, if a claim is made, both policies will respond and contribute.

What Does Vrbo Insurance Cover?

The program offers liability coverage of up to $1.0 million per occurrence per rental agreement, along with medical payment coverage of up to $5,000. There is an aggregate limit of $1.0 million per policy period for each property listed on Vrbo during the policy term.

This insurance specifically covers the following situations:

- Injury to Guests: If a guest is injured during their stay due to an accident, this program provides coverage for claims made against you.

- Third-Party Property Damage: If a guest accidentally damages a third party’s property during their stay, this program may cover any claims related to that damage.

Vrbo Insurance: What Are the Alternatives?

You may have noticed that Vrbo liability insurance does not cover damage caused by travelers to your property.

It’s important to note that if travelers damage your property, the $1 million liability insurance will not cover those losses.

Therefore, you must take additional steps to protect your Vrbo property from potential damage.

1. Vrbo Damage Deposit

For short-term rental owners, a damage deposit is a crucial form of protection. It offers the most basic assurance—money—that hosts can use to cover any potential damage caused by guests during their stay.

For guests, this deposit encourages more careful behavior. They know that as long as they leave the property undamaged, they can recover their full deposit upon checkout.

You can collect a damage deposit in 3 ways:

① Set a Damage Deposit Amount in Vrbo:

You can configure a specific amount for the damage deposit in your Vrbo settings.

If your guests cause damage to your rental property, they will be liable for this amount.

After checkout, you have up to 14 days to file a claim. Vrbo will charge this amount directly to the credit card the traveler used for booking (this is the default option).

② Require a Refundable Damage Deposit:

Your guests can pay this deposit at the time of booking. Vrbo will hold this deposit throughout the reservation process and during the guest’s stay.

If no claims are made, the damage deposit will be refunded to the guests 14 days later.

However, if you file a claim, Vrbo will evaluate it and deduct the appropriate amount from the prepaid deposit.

③ Collect a Deposit Through Hostex:

Hostex, as a professional short-term rental management system, also offers a deposit feature.

This method is similar to Vrbo’s refundable damage deposit, but you have complete control over the funds.

If any accidental damage occurs, you won’t need to worry about the platform siding with the guest. You can decide how much to deduct based on the situation.

2. Vrbo Damage Protection

Property Damage Protection is optional insurance that you can allow guests to purchase.

If any accidental damage occurs to the rental property during their stay, this insurance will provide coverage up to a specified limit.

- Vrbo Damage Protection is underwritten by a trusted insurance company and covers a broader range of potential losses.

- Both hosts and guests can choose different insurance options based on their preferences and property needs. The coverage limits and deductibles can accommodate various budgets.

- Vrbo Damage Protection covers, but is not limited to: Accidental damage and breakage, Leaks, or Property loss.

- Some plans may even cover repair costs for items like cleaning fees or broken glass.

- Unlike refundable damage deposits, the property damage protection plan is non-refundable. Hosts can either pay the premium to insure their property or pass the cost onto the guests.

- Guests will see the property damage protection fee during the booking process.

- Guests can purchase extra travel insurance, which includes Vrbo cancellation insurance. This can protect their travel expenses if they need to cancel or encounter issues during booking or check-in.

- Guests can decide during the booking process whether to opt for this option. Guests also have the choice to pay the Vrbo Damage Protection amount as a refundable damage deposit instead of a non-refundable fee.

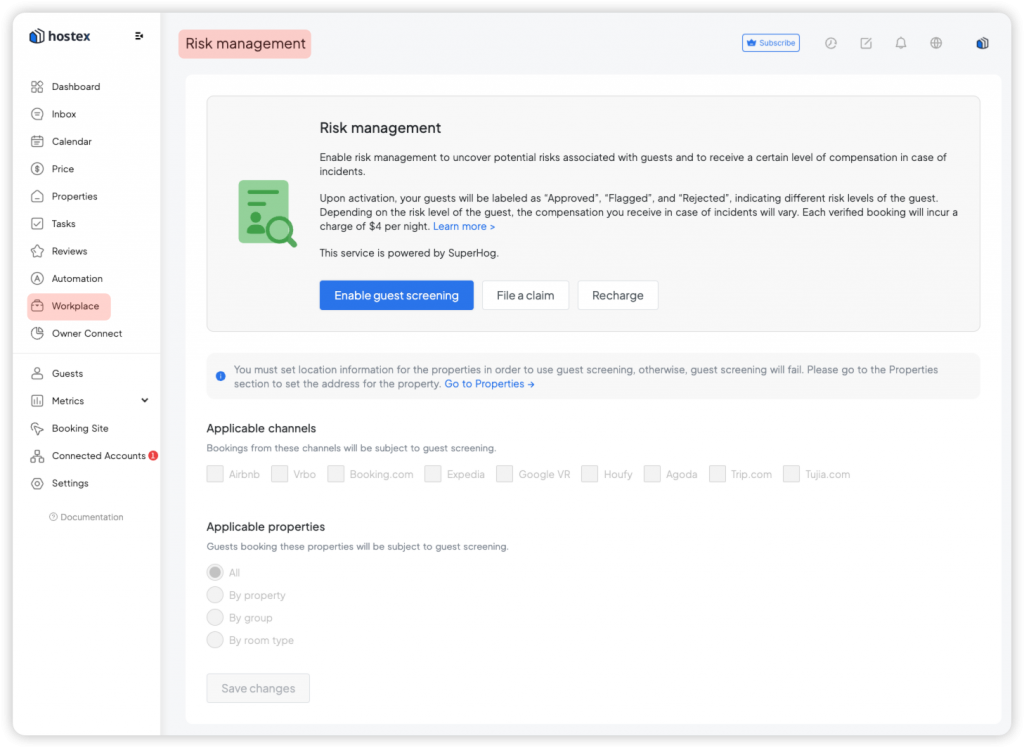

3. Guest Screening

Even with the utmost caution, exceptions can occur. However, you can still conduct an overall risk assessment of guests at the time of their booking.

- All guests must present valid identification to verify their age when checking into your accommodation. Acceptable forms of ID include a driver’s license, passport, or national identity card.

- You can enable screening services for your property. The guest screening service conducts background checks on each booked guest using internet databases to flag potential risks.

- Additionally, you can activate risk protection services. If any guest causes damage to your property, this service will provide you with coverage.

Hostex integrates with Truvi (formerly SuperHog) to offer vacation rental hosts a guest screening and risk management features.

Common Questions About Vrbo Insurance

What is the average amount for a Vrbo damage deposit?

Choosing the right amount for a damage deposit is crucial.

A deposit that is too high may deter potential guests, while one that is too low may not provide adequate protection and could give the impression that your property is of lower quality.

Generally, hosts in the U.S. set the average damage deposit between $250 and $500 as a flat rate.

If you prefer to charge a percentage, it’s typically around 10% of the total rental cost. If the 10% calculation significantly exceeds the flat rate, it’s usually better to go with the percentage option.

The deposit amounts can vary greatly depending on the region and type of property. Therefore, it’s advisable to check what other hosts are charging for similar properties before making a decision.

How do I file a Vrbo damage claim?

Once you have collected a deposit through Vrbo, you have 14 days to assess the property and file a claim after the guest checks out.

Most damage deposit claims are processed immediately, and the funds will be deposited into your account within 3-7 business days.

Here are the steps to initiate a claim:

- Log in to your account and select your property listing (if you have multiple rental properties).

- Click on the inbox and select the guest’s name. You can filter your conversations using the dropdown menu.

- Go to the damage protection section and click on “Report Damage.”

- Enter the damage amount you wish to claim (it cannot exceed your damage deposit).

- Provide a description of the damage (this message will be sent to your guest).

- Click “Confirm.”

Vrbo also encourages hosts to contact guests directly before filing a claim. Having this open dialogue allows you to discuss the damage, and the amount you intend to charge, and provide any evidence, such as before-and-after photos. This can help reduce the likelihood of a dispute.

What is the Vrbo damage waiver fee?

The damage waiver fee is a non-refundable prepaid charge included in the total rental price.

It’s a standard fee for many vacation rentals that protects guests from having to pay upfront for minor damages (like furniture damage, spills, or surface scratches and stains).

Many guests prefer to pay this additional fee as it avoids the need for a large deposit before check-in.

However, it’s important to note that the damage waiver does not cover intentional damage (such as damage caused by parties) or damage resulting from violations of house rules (like breaching a no-smoking policy).

Final Thoughts

When renting out your property to travelers, taking certain measures to protect yourself and your assets is essential.

Vrbo guests are responsible for respecting your property, but remember that you also have to be well-prepared.

- Your short-term rental should be thoroughly cleaned and ready to welcome guests before each check-in.

- Communicate the house rules clearly to guests before their arrival to avoid disputes.

- Maintain open communication with guests throughout their stay to address any issues they may encounter.

These basic daily tasks can be tedious and time-consuming, often requiring significant work. Therefore, you might consider hiring a team to assist you.

Professional vacation rental software like Hostex can help automate nearly all tasks. From automatically responding to inquiries and confirming reservations to sending check-in instructions and assigning cleaning tasks, you won’t need to do it all yourself.

With Hostex’s powerful capabilities, you can easily manage all your listings across multiple OTA platforms from a single platform.